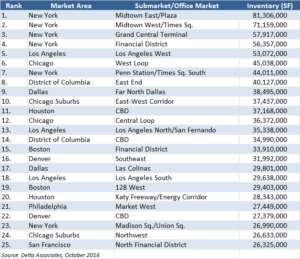

The Largest Office Submarkets in the United States

Based on market research and data aggregated from a variety of sources, we have compiled a list of the largest office submarkets by total inventory in the United States. The table below lists the top 25:

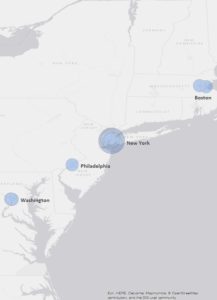

Not surprisingly, submarket in New York dominate the top 5 spots, and account for a fifth of the entire top 25 spots. Overall, the 10 most populous cities in the country are well represented, although Phoenix, San Antonio, San Diego, and San Jose are absent. Notably, Boston, the District of Columbia, and Denver, which have historically robust economies, each have two submarkets ranked among the 25 largest , despite having populations of less than 700,000 residents. The densely populated Northeast Corridor, which accounts for roughly 20% of the nation’s GDP, is home to 11 of the 25 submarkets on the list.

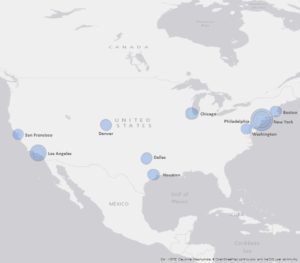

Map of the 25 largest office submarkets in the United States

Map of the 25 largest office submarkets in the United States

Nearly half of the submarkets listed are non-core/CBD submarkets, such as Las Colinas in Dallas and Chicago’s East-West Corridor. Most of the office space in these “suburban” submarkets (some are located within the boundaries of the central cities, particularly in the South and West) are mostly located in single-use office parks along major highway arteries. In many markets areas across the nation this type of product is experiencing rising vacancy, with limited new construction.

In recent years tenants have been favoring properties with good access to transit, as well as nearby retail and dining options. Developers have responded by adding a mix of uses to office parks, and some governments have taken the step of extending transit lines to suburban submarkets, such as the Metro Silver Line in Northern Virginia’s Tysons submarket (ranked #31 in total inventory). Product with the potential for redevelopment/repositioning into a mixed-use destination present an excellent value-add opportunity to CRE investors.

The largest office submarkets located along the Northeast Corridor

The largest office submarkets located along the Northeast Corridor

Looking ahead, we expect submarkets with heavy construction activity, such as those in Dallas, San Francisco, and Boston to move up a spot or two in the coming years as submarkets in the Chicago Suburbs and Philadelphia hold their position or drop in the ranking.