Fed Gets Aggressive with Interest Rate Hikes to Restrain Unbridled Inflation

Marriner S. Eccles Federal Reserve Board Building in Washington, DC

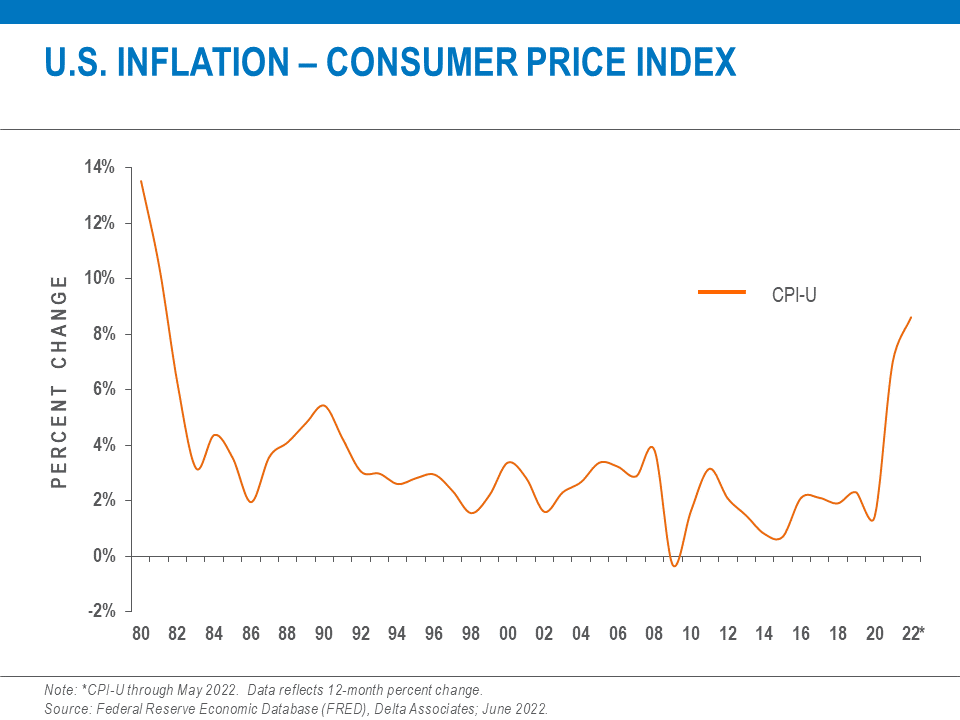

In Delta’s Q1 2022 National Economy report we noted that “out-of-control inflation, the Russian invasion of Ukraine, and a new sub-strain of COVID…dramatically increase the risk of a recession in the near-term.” Fast-forward a few months to present and nearly all these factors have worsened, resulting in an economy now teetering precipitously close to recession. The pace of consumer price inflation has dramatically escalated to a new 40-year high of 8.6% in May.

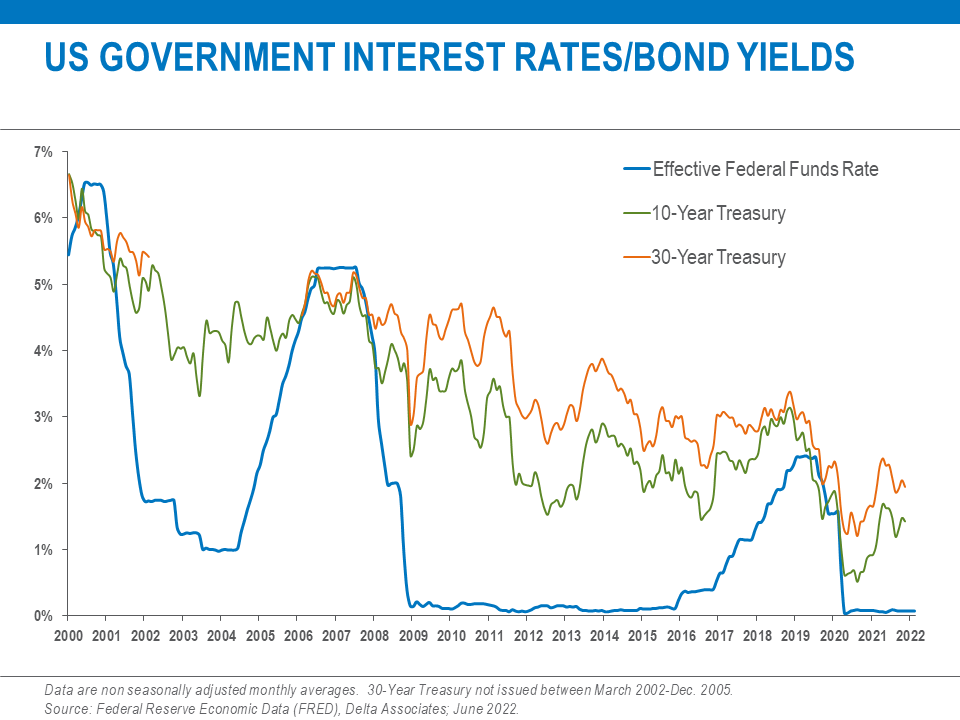

In response to the current hot streak of inflation the Federal Open Market Committee (Fed) has implemented a plan to steadily increase the benchmark federal funds rate. Earlier in 2022, the Fed anticipated at least seven 25 basis-point (0.25%) increases through 2022, beginning with an initial hike at the board’s March meeting—the first rate increase since 2018. However, prices continued to increase unchecked thanks to very strong inflationary forces and remarkably resilient consumer spending. As a result, the Fed implemented a “jumbo” 50 bps rate increase (which we did note as a possibility in our Q1 report) in May, which again had little effect. Consequently, the Fed decided to increase rates by 75 basis points for the first time in decades at its June meeting this week.

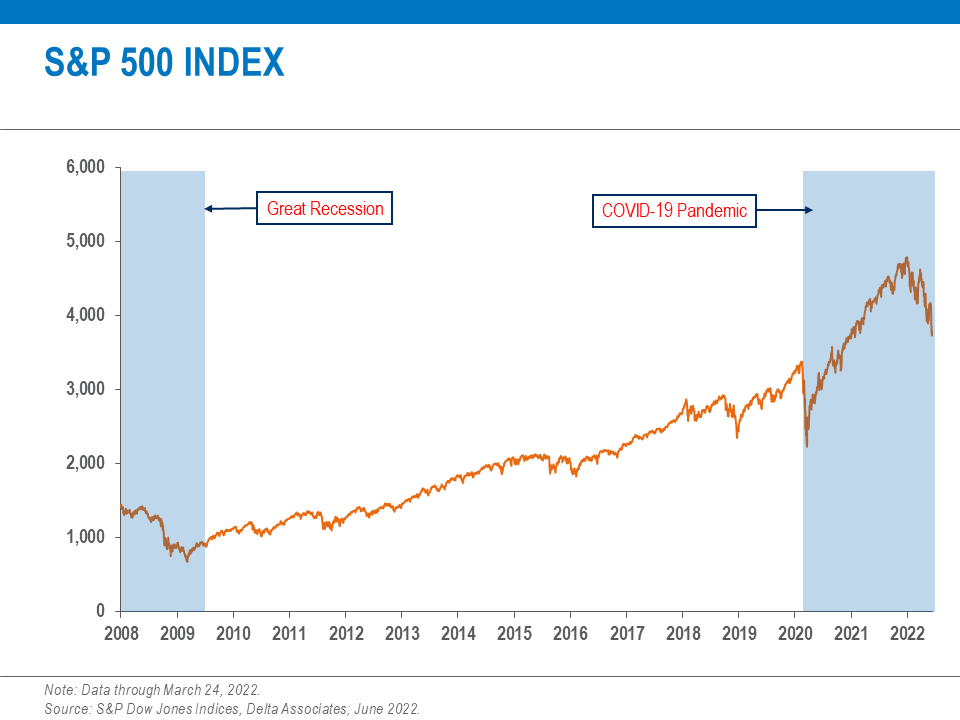

Despite the depressing effect higher interest rates will have on the U.S. economy, Fed Chairman Jerome Powell maintains that a “soft landing” (that avoids a recession) is still possible. Nevertheless, Wall Street has reacted negatively to the aggressive rate hikes, with the S&P 500 officially entering bear market territory at the beginning of the week. The private sector had heavily benefited from the unusually long period of very cheap money which facilitated strong business investment, record profits, and a major wave of merger and acquisition activity.

For commercial real estate stakeholders, a high interest rate environment (coupled with higher costs) could mean a slowdown in deal activity, especially for the hot multifamily and industrial sectors which have already shaken off the negative effects of the pandemic. On the positive side, the Fed’s program to combat inflation should alleviate some economic uncertainty, albeit only slightly.